Generated Title: NV Energy's New Math: Why a 'Fairness' Fee Looks a Lot Like an Illegal Penalty

A new line item on an electricity bill rarely sparks a legal firestorm, but that’s precisely the situation unfolding in Nevada. Last month, the Public Utilities Commission (PUC) of Nevada approved a $119 million rate hike for NV Energy. Buried within that approval is a novel and controversial mechanism: a mandatory “peak demand charge” for residential customers in Southern Nevada. NV Energy frames this as a matter of fairness. The state’s own Bureau of Consumer Protection (BCP), however, has a different, more severe assessment: it’s illegal.

The dispute is now headed for a critical hearing on November 18, where the PUC will be forced to reconsider its decision. At stake isn't just a few dollars on a utility bill, but the legal guardrails that separate legitimate rate design from punitive, and potentially unlawful, financial engineering. And as we dig into the numbers and the statutes, the utility’s rationale begins to look remarkably thin.

Deconstructing the Charge

The mechanism itself is deceptively simple. NV Energy will now identify the single 15-minute window each day when a household uses the most electricity. That peak usage, measured in kilowatts, is then multiplied by a new demand rate of $0.14 per kilowatt. This daily charge accumulates over the billing cycle. The utility argues this aligns costs with the strain individual users place on the grid.

The problem, as the BCP points out in its petition, is that this appears to be a direct violation of Nevada state law. The statute explicitly prohibits the PUC from approving a rate for a residential customer that “is based on the time of day, day of the week or time of year” unless the customer voluntarily chooses such a plan. The BCP’s filing makes a devastatingly simple point by quoting the PUC’s own order, which admits the demand charge “‘varies based on the time during which the electricity is used.’” It’s a direct contradiction, laid bare in the commission’s own words.

This isn’t just a theoretical legal debate. It has a tangible, and seemingly targeted, financial impact, particularly on the state’s rooftop solar customers. A separate Nevada law prohibits utilities from imposing any fee on solar-generating customers that is different from what non-solar customers in the same class pay. Yet, this demand charge systemically penalizes them. A solar household generates its own power during the sunny, high-demand afternoon hours but draws from the grid at night—a time when overall grid demand is lowest. As pointed out in a LETTER: NV Energy’s attack on solar power, their 15-minute peak is almost guaranteed to occur at night.

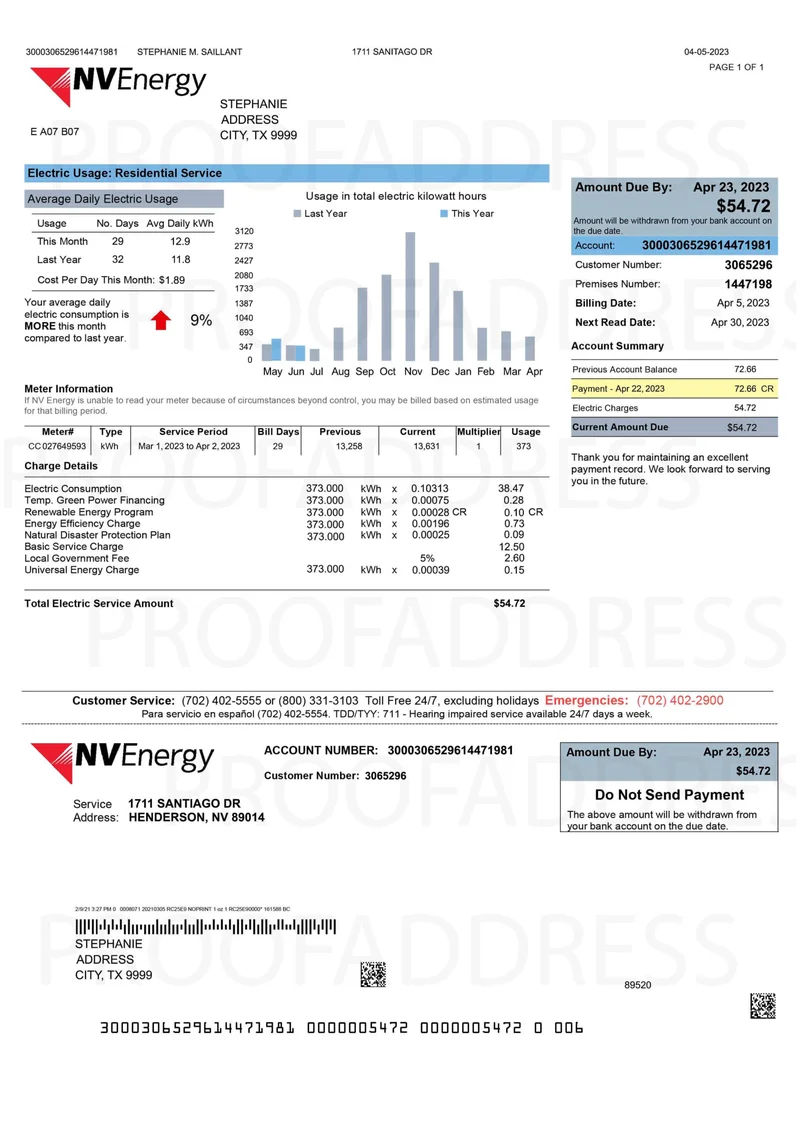

The financial impact is not trivial. NV Energy’s own media relations manager, Meghin Delaney, pegs the increase for the average solar customer at around $12 per month. One solar owner, however, calculated that this represents a 62% increase in their monthly bill. This discrepancy is significant. It suggests that while the absolute dollar amount may seem small, the relative impact is substantial—enough, he argues, to extend the payback period for his solar investment from nine years to fifteen. That’s a material change in the financial calculus for any homeowner.

I’ve analyzed dozens of utility rate cases, and this is the part of the filing that I find genuinely puzzling. The argument from the BCP isn’t based on a complex interpretation or a vague legal theory; it’s based on the plain text of two separate state laws. The fact that the PUC approved a rate structure that appears to be in direct violation of statute raises serious questions about the commission’s review process. Was this an oversight, or a deliberate reinterpretation of the law? The documents don’t say, but the outcome is the same.

The Flawed Logic of 'Fairness'

NV Energy’s public-facing argument is built on a foundation of fairness. The utility claims that its 10% of customers with rooftop solar are subsidized by the other 90% to the tune of $50 million a year. This new charge, they contend, is designed to make solar users pay their “fair share.” It’s a compelling narrative, pitting neighbor against neighbor. But the data behind that $50 million figure remains opaque, and the argument conveniently ignores the value solar users provide by feeding clean energy back into the grid, reducing peak strain, and helping Nevada meet its state-mandated energy goals.

When pressed for a legal rationale, the PUC’s justification was even more curious. The commission’s order stated that the “uniqueness of the circumstances in Nevada warrants seeking rate design alternatives.” The BCP’s response was swift and dismissive, calling this rationale invalid and insufficient for implementing a “mandatory untested new time-based rate structure.” Citing “uniqueness” without specific, quantifiable data is a classic tell in regulatory filings. It’s an attempt to create a special exemption where none exists, and it rarely holds up under serious scrutiny.

The public response, which the BCP describes as “vehemently negative, confounding and filled with fear of rate-shock,” serves as a potent qualitative data set. You can almost picture the scene at the PUC consumer session: fluorescent lights overhead, a microphone stand, and a line of frustrated ratepayers clutching their bills, trying to understand a complex new charge that feels more like a penalty than a fair assessment. This isn't just anecdotal grumbling; it's a market signal that the utility and its regulator have failed to justify their actions. This sentiment is amplified by the fact that no other investor-owned utility in the United States currently mandates a peak demand charge for residential customers. Nevada is an outlier.

Compounding the issue is another change, this one targeting future solar adopters in Northern Nevada. The PUC approved NV Energy’s plan to calculate credits for excess solar energy every 15 minutes instead of monthly. This accounting change is expected to raise bills by about $11 a month and, critically, deter future investment by lengthening the return-on-investment period. Taken together, the two policy changes don’t look like an attempt at fairness. They look like a coordinated, multi-pronged strategy to undermine the economic viability of residential solar in the state.

The Legal Math Doesn't Add Up

My analysis suggests this isn't a case with nuanced legal arguments on both sides. The Bureau of Consumer Protection has presented a clear, text-based argument that the PUC’s decision violates Nevada law. NV Energy’s narrative of a "$50 million subsidy" is a convenient distraction from the core legal question. The upcoming hearing isn't just a procedural step; it's a critical test. The PUC can either acknowledge its apparent error and reverse course, or it can attempt to "harden" its order for an inevitable court battle—a battle that Jon Wellinghoff, the state’s first consumer advocate and former FERC chairman, predicts the BCP will win on appeal, a view detailed in NV Energy peak demand charge, tweak to net metering, violate state law, say experts • Nevada Current. The numbers, and the law, appear to be squarely on the side of the consumers. The only remaining question is whether the commission will agree.