For a market that thrives on drama, last week was an exercise in cold, hard arithmetic. While the usual geopolitical theatrics played out on the global stage, crude oil prices ignored the script. Instead of reacting to threats and summits, the market looked at the numbers on a spreadsheet and didn't like the equation it saw. The result was a steady, relentless bleed-out that saw West Texas Intermediate (WTI) plunge below the critical $60 mark, a level it couldn't reclaim.

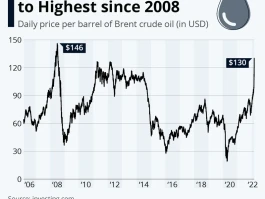

Anyone watching the ticker could feel the methodical pressure. It wasn't a panic-driven crash; it was the slow, grinding descent of an asset class succumbing to the weight of its own supply. WTI began the week at $60.17, a brief flirtation with optimism, before beginning a five-day stair-step down to a low of $56.60. Brent crude followed in lockstep. This wasn't about a single headline. This was about a fundamental, structural problem that has been building for months, and the market has finally decided to price it in.

The Anatomy of an Unignorable Glut

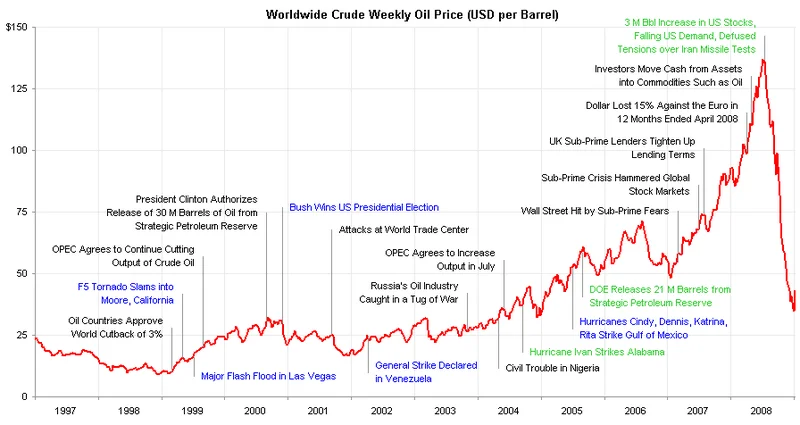

The narrative for oil in recent years has been dominated by geopolitical risk premiums. The mere hint of conflict in the Middle East or a harsh word from a world leader was enough to add a few dollars to the barrel. But that premium has evaporated. Why? Because the market is staring down the barrel of a supply glut so significant it's beginning to overshadow everything else.

The data is unambiguous. The latest Energy Information Administration (EIA) report showed a commercial crude inventory build of 3.5 million barrels, pushing the total to 424 million. This wasn't a fluke; it was driven by a sharp drop in refinery utilization. Think of it like a reservoir. The inflow pipes—US production is humming along at 13.6 million barrels per day—are wide open, but the main outflow valve to the refineries has been partially closed. The water level has nowhere to go but up.

And this isn't a short-term blip. The International Energy Agency (IEA) in Paris essentially confirmed the market’s worst fears. Their latest forecast sees oil supply growth of about 3 million barrels per day—to be more exact, 3.0 million b/d for 2025—followed by another 2.4 million b/d in 2026. Global demand is expected to rise, but not nearly enough to absorb that tidal wave of new supply. I've looked at hundreds of these market reports, and it's rare to see such a clear, long-term divergence between projected supply and demand. The market is forward-looking, and the future it sees is saturated.

The WTI/Brent spread has also tightened considerably (down to $4.05), which suggests the market is pricing in a particularly acute glut in the United States. This isn't a global abstraction; it's a physical reality of tanks filling up in Cushing, Oklahoma.

When Geopolitical Noise Goes Mute

What makes this recent price action so fascinating is the sheer number of geopolitical stories the market chose to ignore. In a normal environment, any one of these could have sent prices soaring. Today, they are either being interpreted as bearish or dismissed as irrelevant noise against the signal of oversupply. It's a textbook example of a market where, Without geopolitical risk, oil prices fall on supply glut.

The ongoing US-China trade dispute is the one political factor that still carries weight, but its impact is entirely on the demand side of the ledger. The threat of 100% tariffs and the hardline stances from both Washington and Beijing have cast a pall over global economic growth forecasts. Less growth means less demand for energy, adding yet another bearish weight to the scales.

Meanwhile, other events that would typically introduce a risk premium are now having the opposite effect. A proposed meeting between Trump and Putin to discuss the war in Ukraine is viewed not as a sign of global instability, but as a potential pathway for more Russian crude to hit the market. The Israel/Hamas ceasefire, despite a few cracks, is largely holding. This removes a significant source of Middle East risk premium that has been baked into oil prices for months.

Then there’s the background hum of domestic economic anxiety. A potential US government shutdown, layoffs announced by oil majors citing unsustainable prices, and worrying signs in commercial lending portfolios all contribute to a sense of impending slowdown. The market is no longer pricing in the risk of a future conflict; it's pricing in the reality of a present supply glut and a potential future recession. What happens when the fear of having too much oil outweighs the fear of not having enough? We're finding out right now.

The Gravity of Simple Math

For months, the oil market has been a story of competing narratives. On one side, you have the geopolitical fearmongers pointing to every potential flashpoint as a reason for prices to hit triple digits. On the other, you have the quiet, boring data analysts pointing to inventory builds and production forecasts. Last week, the analysts won. The numbers became too loud to ignore.

The price action wasn't driven by algorithmic panic; it was a rational repricing based on the fundamentals of supply and demand. The political drama can create volatility, but it cannot defy the gravity of a saturated market indefinitely. The real fear in the energy sector today isn't a stray missile in the Red Sea; it's the prospect of a slowing global economy that simply doesn't need the record amount of oil we're pulling out of the ground.

This raises two critical questions that the data doesn't yet answer. How long can OPEC+ nations maintain production discipline when their market share is being eroded by this non-OPEC supply growth? And at what price point does the pain for producers become so acute that the narrative finally shifts back from supply fundamentals to geopolitical desperation?