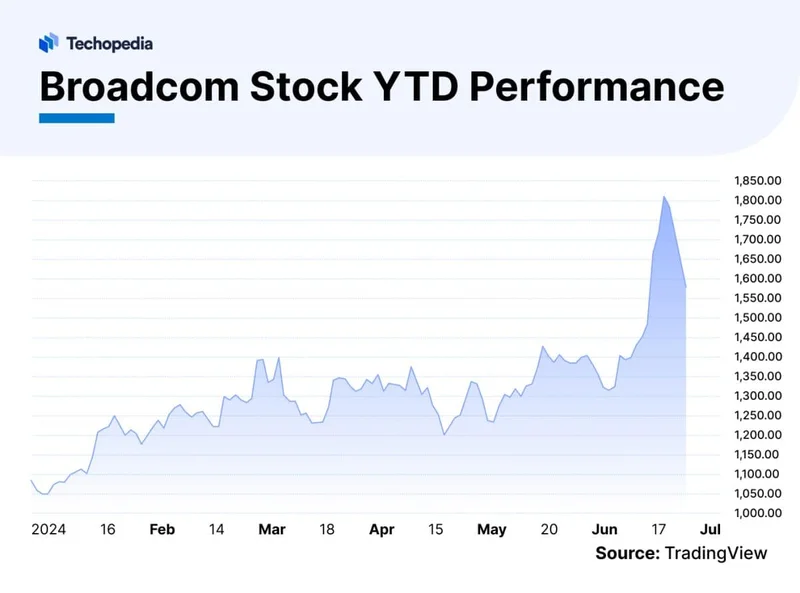

So, we’re just supposed to clap like trained seals for the latest "strategic partnership," are we? OpenAI and Broadcom, holding hands, skipping into a future powered by 10 gigawatts of custom silicon. The press release, offcourse, is a masterpiece of corporate nonsense, full of buzzwords like "accelerate" and "deploy." Wall Street certainly bought it, sending Broadcom's stock soaring over 10% on the news.

I can just picture it. A bunch of guys in fleece vests staring at their Bloomberg terminals, seeing the ticker AVGO go green, and thinking they've just witnessed the second coming of innovation. They're not seeing a partnership. They're seeing a dollar sign. And they're completely, utterly, missing the point.

This isn't a partnership. Let's call it what it is: another vassal state bending the knee.

The Chip-Maker Hunger Games

Remember a few weeks ago? OpenAI made a spectacular show of its 10-gigawatt deal with Nvidia, complete with a casual $100 billion investment. It was a coronation. Then, not long after, they tossed a 6-gigawatt bone to AMD, sweetened with the right to buy a fat 10% stake in the company. Now, it’s Broadcom’s turn to get in line and present its offering.

This isn’t a strategy; it’s a shakedown. OpenAI is acting less like a tech company and more like a Vegas high-roller playing with house money, spreading billion-dollar chips across the entire semiconductor felt. They’re betting on Nvidia, AMD, and Broadcom simultaneously. Why? Because when you have this much power and this much capital, you don't have to pick a winner. You can just buy the whole casino.

The most telling detail is buried in the jargon: OpenAI is designing these new "XPUs." Broadcom is just the hired muscle, the contract manufacturer with a fancy name. This is like telling a master chef you’ll partner with them on a new restaurant, but you’re providing the menu, the recipes, and the ingredients, and they just need to cook it and smile for the cameras. Who really owns that restaurant? What happens when you decide to take your recipes to the kitchen down the street?

This whole thing ain't about finding the best tech. It’s about ensuring no single chipmaker can ever hold them hostage. By becoming the biggest and most important customer to all of them, OpenAI makes itself indispensable. They’ve created a system where their suppliers are now their competitors, fighting each other for the privilege of building OpenAI’s empire for them. It's brilliant, in a completely terrifying, monopolistic sort of way.

Wall Street's Blindingly Stupid Optimism

And the market? The market loves it. The analysts are tripping over themselves to praise the deal. I saw one quote from a Melius Research guy, Ben Reitzes, in Why Broadcom Stock Skyrocketed Monday Morning - The Motley Fool, predicting Broadcom will eventually capture 30% of the AI chip market. Thirty percent! That sounds great, until you ask the obvious follow-up question: thirty percent of a market whose roadmap is being dictated by a single customer? Is that really a win?

This is a bad deal for Broadcom. No, "bad" doesn't cover it—this is a Faustian bargain. They get a short-term stock bump and a big purchase order, and in exchange, they hand over the keys to their own future. They become a feature, not a platform. The financial world is celebrating a company willingly putting on its own golden handcuffs because, for one brief, shining moment, those handcuffs boosted the quarterly earnings report.

We’re told Broadcom’s stock is "attractively priced," with a PEG ratio of 0.38. That's the kind of soulless metric that makes sense only if you believe the world is a spreadsheet. It completely ignores the narrative, the power dynamics, the raw, uncut ambition on display here. OpenAI isn’t just buying chips; it’s buying leverage. It’s buying the entire supply chain, piece by agonizing piece. And they want us to believe this is just about 'accelerating models' and not about cornering the entire...

Then again, maybe I’m the crazy one here. Maybe this is just how the world works now. A handful of tech giants carve up the entire economy, and our job is to cheer for the stock price of the company that gets carved up the least. It’s exhausting. I need a coffee. Or something stronger.

The real question isn't whether this is a good deal for Broadcom's shareholders on a Monday afternoon in October. The real question is, what happens in five years when OpenAI, having learned everything it needs from Nvidia, AMD, and Broadcom about designing and fabricating chips at scale, decides it doesn't need them anymore? What happens when the cuckoo has finally pushed all the other birds out of the nest?

They're Not Building a Moat, They're Boiling the Ocean

Let's stop pretending. This isn't about "partnerships" or "collaboration." This is a quiet, bloodless conquest. OpenAI is systematically dismantling the independence of the entire semiconductor industry, turning the most advanced hardware companies on the planet into glorified contract workers. They're not just securing their supply chain; they're becoming the supply chain. And the scariest part is that everyone with the power to do something about it is too busy counting their money to notice they're being colonized.