So, you’re telling me a company that was basically a Reddit meme a year ago just inked a deal with Verizon, the monolith of American telecoms? And its stock shot up like a SpaceX rocket with Elon Musk’s ego strapped to the front?

Give me a break.

I saw the headlines Wednesday morning. "AST SpaceMobile and Verizon to Provide Direct-to-Cellular Satellite Service." My inbox was flooded with breathless PR pitches. The stock forums were a sea of diamond-hand emojis and proclamations of imminent wealth. It felt like I was watching a replay of 2021, only this time the spaceship is supposedly real.

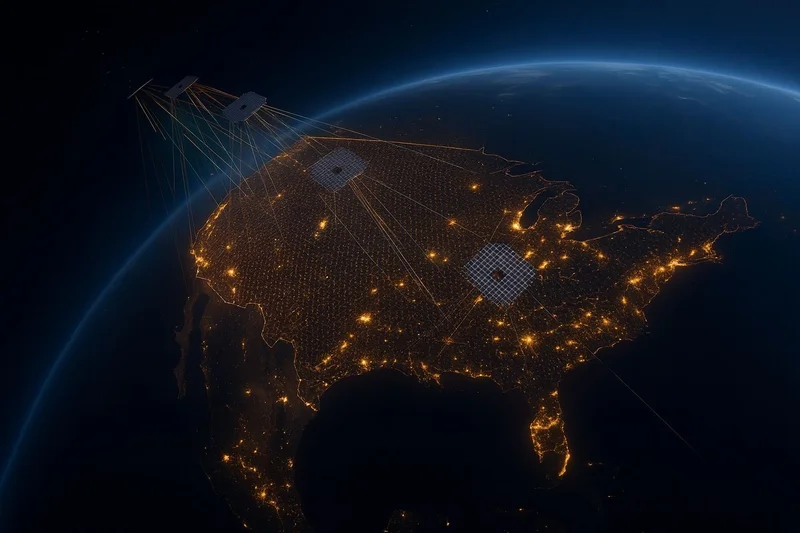

Let’s get one thing straight. The idea is cool. I’ll give them that. Using low-Earth-orbit satellites to beam Verizon’s signal directly to your standard, off-the-shelf iPhone from the middle of the Grand Canyon? That’s the stuff of science fiction. It’s the ultimate fix for every dropped call, every dead zone, every time you’ve cursed your carrier for charging you a fortune for service that disappears the second you leave the suburbs.

But a cool idea and a viable, scaled, profitable business are two very, very different things. And right now, AST SpaceMobile feels a lot more like the former.

The Satellite Savior or Another Blank Check?

On paper, the deal is a masterstroke. Verizon brings its massive customer base and its prized 850 MHz spectrum. AST SpaceMobile brings its "largest commercial communications array ever deployed into low Earth orbit." They hook them together, and by 2026, you can supposedly get a signal anywhere.

Abel Avellan, the founder and CEO, said this partnership will "provide essential connectivity from space directly to consumer mobile phones." My cynical translation? "We're strapping our unproven, cash-burning satellite tech to a trusted brand name to convince Wall Street we're not just a science project."

And it worked. The stock surged. The Wall Street Bets crowd went absolutely feral. Why AST SpaceMobile Shares Are Surging On Wednesday? Because it validates the dream. It makes the meme feel real. For years, this has been a high-risk, high-reward play for retail traders who love the idea of space tech. Now, with Verizon’s stamp of approval, it suddenly looks… legitimate.

But is it? Let's not forget, this is a stock that has been on a wild ride, jumping more than 300% this year alone. It’s a stock that surged last month based on a false report that another company was taking a stake. This thing is less of a stable investment and more of a bucking bronco fueled by rumors and hype. The company literally just filed to sell up to $800 million in stock. They're cashing in on this pop, and everyone is cheering like they just won the Super Bowl, but...

Does anyone stop to ask what happens if the tech hits a snag? What if "2026" becomes 2028, or 2030? What are the real terms of this "definitive commercial agreement"? The press releases are, offcourse, vague on the financials and the penalties. It's a partnership, sure, but how much skin does Verizon really have in this game versus how much ASTS is betting the entire farm on it?

Let's Be Real: This Is Still a Casino

This is a gutsy move. No, 'gutsy' isn't right—it's a Hail Mary pass with Verizon’s branding painted on the football. The company is essentially pre-revenue, burning through cash to get its satellite constellation in the sky. It's a binary bet: either it works, and early investors become fabulously wealthy, or it fails, and the stock goes to zero. There is no middle ground here.

The whole thing reminds me of the dot-com bubble. Everyone was buying into companies with ".com" in their name because they were selling a story about the future, not a product in the present. ASTS is selling the story of "no more dead zones." It’s a powerful story. I mean, my own cell service cuts out in the middle of a major US city if I stand in the wrong corner of my apartment. The idea of getting five bars in the Alaskan wilderness feels like a fantasy.

And maybe that's all this is.

Then again, maybe I'm the jaded one. Maybe this is the future, and I’m just the dinosaur grumbling about how we used to have payphones. Someone has to build the next generation of infrastructure, and it ain't gonna be cheap or predictable. It takes visionaries and gamblers, and right now, ASTS and its investors are playing the part perfectly.

But when I see the jubilant chaos on the forums, I don’t see savvy investors analyzing discounted cash flows. I see people betting their savings on a ticker symbol because it feels exciting. They’re not investing in a company; they’re buying a lottery ticket with a space theme.

This Verizon deal is the equivalent of the lottery commission announcing the jackpot just got bigger. It doesn’t change the odds of you actually winning. It just makes the dream you’re buying feel a little more vivid before you wake up.

So, Who's Getting Played Here?

Let’s call this what it is. This isn't about technology, not really. It's about hype, validation, and a perfectly timed capital raise. The "genius move" is on the part of AST SpaceMobile's management, who just secured a massive vote of confidence that they can immediately turn into cash to fund their operations. Verizon gets a low-risk, high-reward lottery ticket and some great PR about being on the cutting edge. The retail traders? They get to ride the wave, but they better know exactly when to jump off, because this ain't a cruise ship. It's a rocket, and not all of them make it to orbit.