The headline is a promise. My article must deliver.

Title: The Social Security 2026 COLA Update Is a Glimpse Into a Broken System. Here’s How We Can Build a Better One.

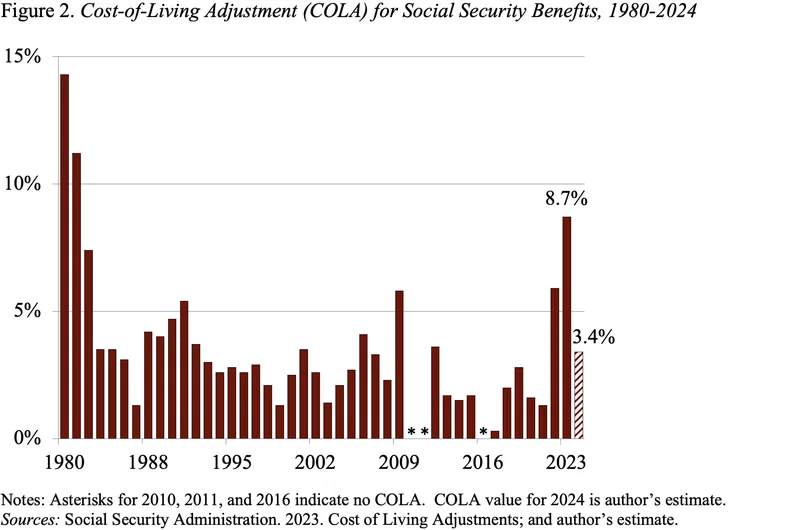

Every year, we go through this same ritual. Sometime in the fall, a number is announced—the cost-of-living adjustment, or COLA—and for a few days, we all become armchair economists, debating whether it’s enough. This year, the preliminary chatter is coalescing around 2.7 percent.

Imagine it for a second. An envelope arrives. The paper feels thin, official. Inside, a letter confirms that your monthly check, maybe $2,000 after a lifetime of work, will go up by about fifty-four bucks. Fifty-four dollars. Enough for a few extra bags of groceries, maybe. A welcome cushion, to be sure, but a cushion against what? A tidal wave of rising costs?

The annual social security 2026 cola update isn't just a number. It's a symptom. It’s a diagnostic reading from a system designed for a world that no longer exists, and it’s telling us the machine is starting to strain.

When I see these numbers, I don't just see a budget line item; I see a massive, fascinating data problem begging for a modern solution. We’re putting a Band-Aid on a deep, structural wound, and I can't help but feel an incredible sense of excitement about what could come next if we just had the courage to think bigger.

The Analog Engine in a Digital World

Let's be clear about what’s happening. On October 15, 2025, the Social Security Administration will finalize this COLA. At the same time, they’ll announce an increase to the taxable wage base ceiling. That’s the maximum amount of income that’s subject to Social Security tax—in simpler terms, it means higher earners will pay a bit more into the pot. Experts like Alex Beene at the University of Tennessee rightfully call this a way to get "desperately needed" money into the program.

And he’s not wrong. But this is like finding a clever way to get a little more performance out of a steam engine. It’s impressive, but a hyperloop is being built next door. We’re tweaking the dials on an analog machine while the rest of the world has gone digital. The entire framework—from the 40 "work credits" you need to qualify (a concept based on a 9-to-5, lifelong-career model) to a single, nationwide inflation metric—is a relic. It’s the public policy equivalent of the U.S. Postal Service trying to compete with email by offering a new line of faster stamps. It’s a noble effort, but it completely misses the paradigm shift that has already occurred.

Kevin Thompson of 9i Capital Group hit the nail on the head when he said these tweaks "won’t fix the long-term solvency problem." Most people hear that and feel a sense of dread. I hear it and see a call to action. He’s absolutely right. These patches won't fix the core architecture. So why do we keep pretending they will? Why aren't we having a more exciting conversation? The conversation about what a 21st-century social safety net could look like.

What is the fundamental flaw here? We’re using a blunt instrument to solve a deeply personal problem. We use one national inflation number to calculate a benefit for 70 million unique individuals living in wildly different economic ecosystems—from rural Mississippi to Manhattan—and we act surprised when the outcome feels inadequate and disconnected from reality. It’s a beautiful, elegant, 20th-century solution that has been completely outpaced by the complexity of the 21st.

A Blueprint for Social Security 2.0

So, let’s dream for a minute. Let’s stop patching the old code and start imagining a new operating system. What if we built a system that was as dynamic and responsive as the world we actually live in?

Imagine a Social Security system that uses real-time, localized data. Instead of a single COLA, what if your adjustment was tied to a cost-of-living index for your specific county or metropolitan area? We have this data. We have the processing power. We could create a system that understands that a 2.7% bump means something entirely different in Omaha than it does in San Francisco. Is that not a more elegant, more human solution?

And we have to go deeper. The very concept of "work" is transforming before our eyes, yet the system is still built on the foundation of the post-war industrial economy. The gig economy, remote work, portfolio careers, the looming impact of AI on entire job sectors—these aren’t edge cases anymore, they are rapidly becoming the norm and our system for social insurance is utterly blind to this seismic shift. The speed of this change is just staggering—it means the gap between how we live and work today and how our safety nets are designed is widening faster than we can even comprehend.

Of course, building this new system comes with immense responsibility. We’d have to design it with privacy, security, and equity at its core. A data-driven system must be transparent and accountable, not a black box that spits out numbers affecting millions of lives. The ethical guardrails would be just as important as the code itself.

But are these challenges really any greater than the challenge of trying to keep a 90-year-old system afloat in an economic sea it was never designed to navigate? I don’t think so. One path is a slow, managed decline. The other is a bold, inspiring leap into the future.

A System Ready for Its Upgrade

Forget the 2.7 percent. That number is a ghost, a faint echo from a bygone era. The real story isn't the patch; it's the beautiful, complex, and profoundly human design challenge sitting right in front of us. We have the tools, the data, and the ingenuity to build a social insurance system that is responsive, personalized, and truly worthy of the 21st century. The only thing we're missing is the collective will to stop tinkering with the past and start engineering the future.