[Generated Title]: On-Chain Equities Index: A Solution in Search of a Problem?

Dinari's partnership with S&P Dow Jones Indices to create the S&P Digital Markets 50 Index, and then tokenize it on-chain using Chainlink, sounds impressive. Thirty-five blockchain-related equities and 15 digital assets, all verifiable in real-time. But let’s unpack this. What problem does this actually solve?

The press release boasts about "transparent infrastructure" and "verifiable, real-time index data." Okay, but S&P 500 data is already pretty readily available, and while not "on-chain," it's not exactly shrouded in mystery. Are we really suffering from a lack of transparency in index pricing? I suspect not. The real issue, as always, is access and cost.

Tokenization: Access or Just Another Layer?

Tokenizing the index through Dinari's dShares platform is touted as democratizing access. But does it actually lower the barrier to entry? Let's say the S&P Digital Markets 50 Index trades at, hypothetically, $1,000 per share (or per token, in this case). A traditional brokerage account allows fractional shares. You can buy $5 worth of Apple, no problem. How is a tokenized index fundamentally different, especially if it still requires a brokerage account to access (a detail often glossed over)?

And here's the part of the report that I find puzzling: if the goal is to truly democratize access, why not focus on lowering brokerage fees or creating more user-friendly interfaces for traditional investing? Tokenization adds a layer of complexity—smart contracts, gas fees (even if minimized), and the ever-present risk of smart contract exploits—that the average retail investor neither understands nor needs.

Consider Bankr, mentioned in another article, which aims to make crypto accessible through conversational AI. It's intriguing. The idea of buying Ethereum with a simple text command, "Buy $100 of ETH," is certainly more user-friendly than navigating a decentralized exchange. But even Bankr acknowledges the need for safety and recovery mechanisms, indicating that complexity, while hidden, is still present.

The Allure of "On-Chain": Is It Just Hype?

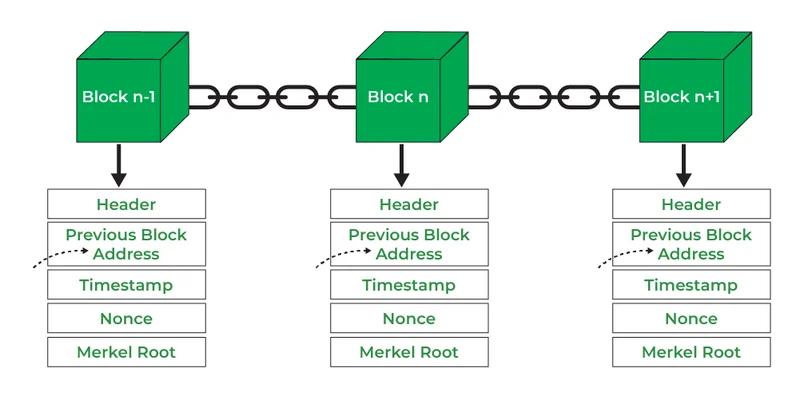

The phrase "on-chain" carries a certain allure in the crypto world. It implies immutability, transparency, and decentralization. But let's be brutally honest: for most retail investors, the practical benefits of these features are minimal. They care about returns, ease of use, and security. The underlying technology is largely irrelevant, as long as those three criteria are met.

The Stellar Development Foundation Joins Blockchain Payments Consortium as Founding Member to define common standards is a step in the right direction. Interoperability is crucial for blockchain payments to gain mainstream adoption. But even with standardized protocols, the fundamental question remains: are blockchain payments significantly better than existing solutions? Faster? Cheaper? More secure? The answer, currently, is "it depends," which is not a compelling sales pitch to the average consumer.

What replaces PayPal, as one article suggests, isn't necessarily a single company, but a pattern. A pattern of meeting users where they are, simplifying complex processes, and prioritizing user experience. The TON chat wallet ecosystem, with its integration of payments and culture inside messaging apps, is a fascinating example. But even there, the focus is on the experience, not the underlying blockchain technology.

The Emperor Has No Clothes

The S&P Digital Markets 50 Index is undoubtedly a technically impressive feat. But it feels like a solution in search of a problem. Tokenizing an index doesn't automatically democratize access, and the benefits of "on-chain" verifiability are largely theoretical for the average investor. Until these solutions offer a demonstrably superior user experience or significantly lower costs, they'll remain a niche product for crypto enthusiasts, not a mainstream investment vehicle.